The Slovak Capital's Situation on the Real Estate Market

The Slovak Capital's Situation on the Real Estate Market

Fears that a bubble was growing in the Central European real estate sector appear to have been averted, as growth in residential property prices has started to slow across much of the region.

Property prices in Slovakia continue to rise strongly, with demand buoyed by low interest rates and robust economic growth. Demand, both from local and from foreign investors, is surging, according to local property experts as there are no legal restrictions on foreigners buying buildings in Slovakia. However, reports from several markets in the region since then indicate a slowing of growth and expectations of a further easing in future.

Overall view on the Region's Real Estate market

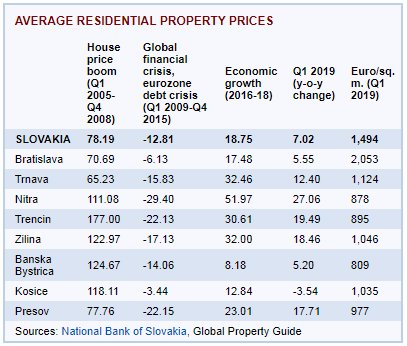

Prices are still growing fast, with the growth in several Central European countries outstripping that in Western Europe. In the second quarter of 2019 Hungary topped Eurostat’s house price index intended to capture price changes of all residential properties purchased by households, followed by Latvia. Czechia, Lithuania, Slovakia and Bulgaria were also among the top 10 countries for upward price moves.

In Europe, slower growth is a common theme but some interesting trends stand out. Central and Eastern European countries continue to perform quite strongly – The Czech Republic (9.4%), Hungary (9.2%) and Slovakia (7.02%). Economists from the Vienna Institute for International Economic Studies believe a bubble has formed in the sector, but not a dangerous one, and certainly not one that will burst in the near future.

Fast growth, demographics and Airbnb

A combination of factors have been causing prices to rise. The economies of the region have been growing fast, in general outstripping the eurozone average in the last couple of years. While they are experiencing some slowdown as a result of the slowing of key European economies in particular Germany, growth remains propped up by private consumption.

Demographics have a mixed impact. Overall, populations are declining in most countries in the region, with mass emigration leaving abandoned homes and villages in rural areas. Yet major cities are booming amid the ongoing migration to urban areas and the growth of industries such as IT and tech. And when emigres do choose to put money back into their home economies, residential real estate is a popular way to do this. Residential real estate as an investment is becoming popular for locals as well.

Then there is the booming tourist industry in cities like Prague, Budapest and even Bratislava that has resulted not only in a wave of investments into hotels but also the conversion of thousands of city centre apartments into short term holiday lets — most listed via the Airbnb platform — further fuelling prices and pricing many locals out of the market.

Rental market is very limited

Bratislava appears to be an attractive location to own properties but anecdotally, properties can be quite hard to let. Bratislava is a small place, and few people absolutely need to live in the centre of town unlike the larger capitals of other countries where commuting times can be inconveniently high. Because Slovakia itself is small, the number of expatriates, embassies, and international companies in Bratislava is small, which again restricts the supply of tenants.

|

Owner-occupancy in Slovakia has risen sharply from about 50% during the 1980s to currently above 90%, making Slovakia the country with the third highest homeownership rate in the EU, way past the EU average of less than 70%. Tenants were only around 9.7% of Slovakia’s population, according to Eurostat. The growth of owner-occupation is partly due to contractual savings system (Bauspar) that makes it easy for Slovaks to obtain housing loans. This Bauspar system allows borrowers to take loans at lower interest rates, with the government paying an interest premium on the amount saved. |

Yields are moderately good; rents are still low

According to the Global Property Guide research in Stare Mesto, Bratislava’s city centre:

- Gross rental yields on 40 sq. m. apartments were around 5.01%.

- Larger units of around 120 sq. m. had slightly lower yields of 4.53%.

- The average yield in Stare Mesto fell slightly to around 4.5% this year, from 5% in 2016 and 5.53% three years ago.

In Bratislava’s less upscale districts of Ruzinov and Nove Mesto (Bratislava II and III), gross rental yields were not much different, between 4.6% to 5.7%. The Airbnb market is thriving but only 0.1% of Slovakia’s housing stock is let out for long term by private landlords, mainly in Bratislava.

Rents range from around €11 (US$12.5) to €14 (US$16) per sq. m. per month in the Old Town of Bratislava, whereas in the nearby areas of Ruzinov and in the New Town, rents range from €9 (US$10.2) to €12.5 (US$14.2) per sq. m. per month.

Sources:

- Residential property prices (National Bank of Slovakia)

- Rental returns are moderate in Bratislava, Slovakia (Global Property Guide)

- The CEE Real Estate Bubble (Intellinews)